Search the Community

Showing results for tags 'tax'.

-

Hello Paul/Tyson/Cody EU Commission Information: http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/telecom/index_en.htm How to Register for and Use the VAT Mini One Stop Shop (MOSS): https://www.gov.uk/register-and-use-the-vat-mini-one-stop-shop VAT Rates by Country: http://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_en.pdf We need to "polish" Eu Billing/Pro-Forma invoices in blesta, there is alredy alot of talk in blesta foruns and a recent one in WebHostinTalk about how blesta needs to go to be fully EU compatible, so I open this forum to male "pressure" for you acomplish every aspect asap Im now finalising a new VAT MOSS Report for blesta (will release later today for free for evryone in EU) (VAT moss its finished please check here ) The most completed and Biggest Thread to fix all issues with EU/Pro-Forma invoices in Blesta Problem: New EU Law Compilant for Data Protection Solution: https://dev.blesta.com/browse/CORE-2463 Problem: Wirth the new EU Law that is active since 1 January 2015, EU consumers have to see prices with TAX of the country of origin. Wen activating tax inclusive or excluse, dosent reflect on order form prices. Solution: Wen a client is not logged in, in blesta, it show show a POPUP to select country of origin, or use GEO to pre select the country, but always have an option to the client change saving as a cookie or session. After that the order forms have to diplay prices with and without TAX, and also shoe the tax rate, for exemple show like this example [Hostin Plan starting at €1.23 and then below a note saying (Prices incl. 23% VAT)] Problem: Wen acidentaly creating an Pro-Forma invoice with "0" (zero) Euros, it converts automaticly to an "Final Invoice", this cannot happen, because sometimes we can make mistakes (i did, I put the price in the quantity field insted of the Unit Cost field) Solution: Do not auto convert "0" (zero) invoices to final invoice. Problem: Pro-Forma invoices numbering are not sequential. (CORE-1287) Solution: Dont reuse numbering wen converting a pro-forma invoice to an invoice, wen creating a new pro-forma invoice. Problem: Final invoices can be edited by Staff/Admin. (added sugestion naja7host) Solution: Wen Pro-Forma is enable on Blesta, put an option in ACL to disable Final invoice editing, only be able to edit "Notes" field on Invoice. Final Invoice (even if unpaid), cannot ever never be "EDITED" by any Staff/Admin with the ACL enable (i know in phpMyAdmin is always possible, but...). Problem: Invoice Details are changed, wen a client changes details in contacts. (i think there is alredy a CORE TASK) Solution: Save as an array the details in the invoice table in a new field Problem: Wen converting to final invoice the date mantains the original date. (CORE-1605) Alredy Fixed but not confirmed Solution: Wen converting to final invoice, put the date of the convertion. Wen there is a final invoice (Paid/UNpaid/Partial Paid), the date as to be always changed to the date of the convertion of the final invoice. Problem: We cannot create a manual final invoice, only Pro-Forma invoices. Solution: Wen Pro-Forma is enable on Blesta, add an option to convert to final invoice, even if unpaid. Sometimes we need to Creat a Final Invoice but "Unpaid". Problem: As I saw in webhosting talk: "the way it handles rounding for the transactions, the system stores the values to 4dp in the db so things like tax rules (as mentioned earlier in thread) and auto foreign exchange rate calculations lead to unexpected results because Blesta does the math to 4dp but Paypal for e.g. only cares about 2dp so the user could pay an invoice and suddenly end up with a 1c credit without knowing what went wrong." Solution: Calculate it better Alredy Fixed but not confirmed Problem: Wen final invoice, the email is not sended to the client. (CORE-1561 but not completed with a second wen Full Paid) Fixed and Confirmed Solution: Send an email with the invoice wen converted to final invoice, and also wen is full PAID. Problem: We dont have an option to create "CREDIT NOTES" wen voiding an invoice. Solution: Auto and Manually create a new type of document/invoice called "CREDIT NOTE" if voiding an invoice, with a new sequential numbering. Problem: Total tax, is not being saved in database on "invoice_lines" table. The value must be saved because rounding issues, this way we have to alwaes calculate tha VAT that was in that time to try to get the correct VAT/TAX total. For exemple for the Vat MOSS to work I have to make extra calculations to make it right, but there are companies that like to round value in Total of the invoice, and people that like to round in total for each line. Solution: Create a new field on invoice_lines table, and save the total vat/tax, also i think is better to sabe also the Tax Rate in this table, and not only the ID of the the external table to get the TAX Rate. Alredy Fixed but not confirmed Problem: Creating an account dosent validate VAT MOSS requirements. Solution: On order from wen creating an account, add option to tell if its a Company or an Individual, if company in "EU Country List" show default blesta company TAX Rule, if its an individual, than use the Tax Rule from the individual country in "EU Country", if the Company and or Individual is outside of EU, then show default TAX Rule from Blesta Company Country. Problem: Wen an pro-forma is converted to final invoice, we cannot find the old pro-forma number for tracking proposes. Solution: Add an option to show on Admin/Staff client invoices a new colum with the old number, and be able to search with the old number also. Problem: Custummers dosent have a Country Select Box to select "Country Tax" to show on Services and on Checkout (yes, i know after register the VAT is recalculated). Solution: Add an option or better yet a BOX to show (wen pro forma is enable in admin) on any Blesta Page wen enterying for the first time, (If not Logged In), to select a Country Flag with a warning telling its to show prices with country VAT. Exemple: All Flags or a drop box for countries If anyone elese as anything to add, or any opinion on how to, please share it here, we need this DONE asap Regards, PV

-

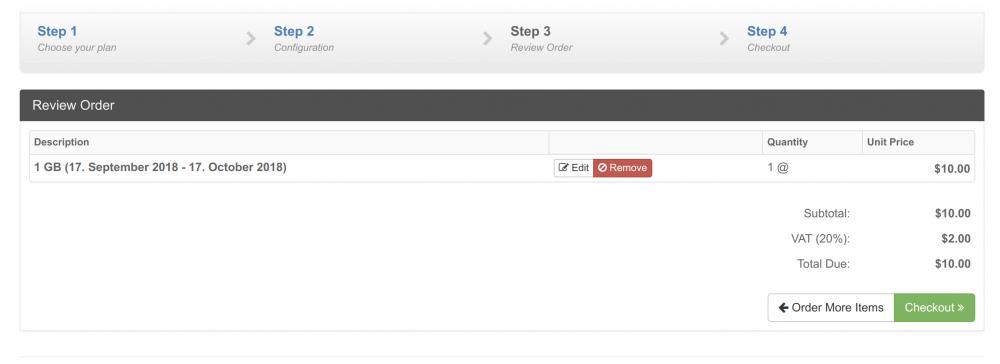

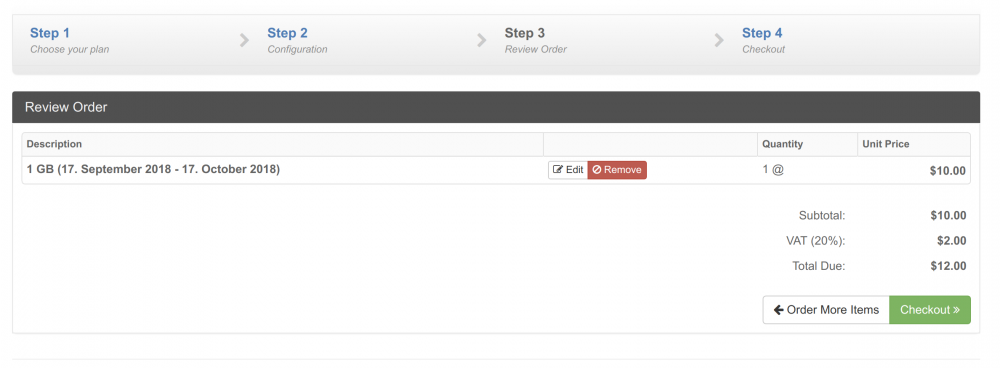

When selecting the "Inclusive" tax type, it adds the tax on top of the items subtotal price which results in a total due of $12 (instead of $10). When selecting the "Exclusive" tax type, it shows the actual Inclusive total due (also on Step 4) of $10 (instead of $12) but the Invoice generated in background and payment amount parsed to the gateway e.g. PayPal is $12. BUG: Inclusive and Exclusive tax amount is incorrect calculated and generated Invoices are different from the amount displayed during the checkout process. This was tested with the Standard, Ajax and Wizard order form. The error appeared on all of them. It's either overcharging the customer, lowering the price to match the desired total price or not charge tax at all. If this is a confirmed bug, the severity is CRITICAL and needs immediate attention.

-

I have created a coupon and gave if a 100% rate, so i can use to test services etc. i also have a tax rate of 4.5% as a processing fee, but adding the coupon only takes into account the plan rate and not the tax, so a plan at £1.50 will at a 7p tax (£1.57) but using the coupon for 100% removes the £1.50, but leaves the 7p as payable how can i get this to be 100% in total discount

-

I'm having some trouble with the calculations of VAT/Sales Tax and invoice totals. For example, I have 2 line items... Line Item 1 -- Quantity 3 -- Unit Price 32.50 -- Cost 97.50 Line Item 2 -- Quantity 3 -- Unit Price 32.50 -- Cost 97.50 Subtotal: 195.00 VAT @ 23.0000%: 44.86 Total: 239.86 The subtotal is 195.00, which is correct. The sales tax on this invoice is 44.86, which is incorrect. 23% of 195.00 is 44.85, so the invoice total should be 239.85, not 239.86. The problem seems to be that the VAT/tax is being calculated on a per line basis, rounded, and then summed up. However, it should be calculated on the subtotal and then rounded. Or calculated on a per line basis, summed up, and then rounded. 23% of 97.50 is 22.425 Rounded, that becomes 22.43. 22.43 x 2 = 44.86. The rounding occurs before the addition. It should occur after the addition. Installed Version 3.6.1